Gold is the only way out for Central Banks!

Many years of loose and unconventional monetary policy have severely damaged financial markets and the global economy.

Currently, central banks find themselves cornered, as the financial system is drowning in debt and addicted to ever easier money.

Gold, however, provides multiple solutions?

Gold can solve three problems central banks are currently facing:

- Lacking inflation: CBs want inflation, so they need a higher gold price.

- Bad debt on their balance sheets: CBs want to repair their balance sheets, so they need a higher gold price.

- Financial instability: CBs want to reset the system with an immutable, neutral and evenly distributed reserve asset? That is gold undoubtedly.

In aggregate, gold will be used to get out of the financial mess.

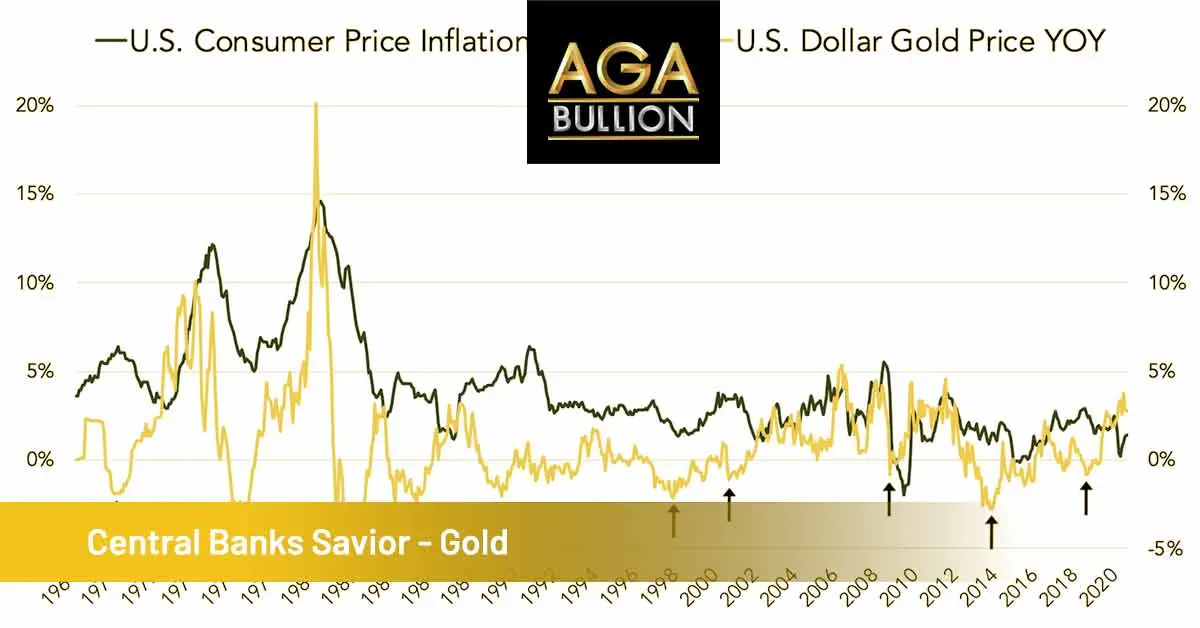

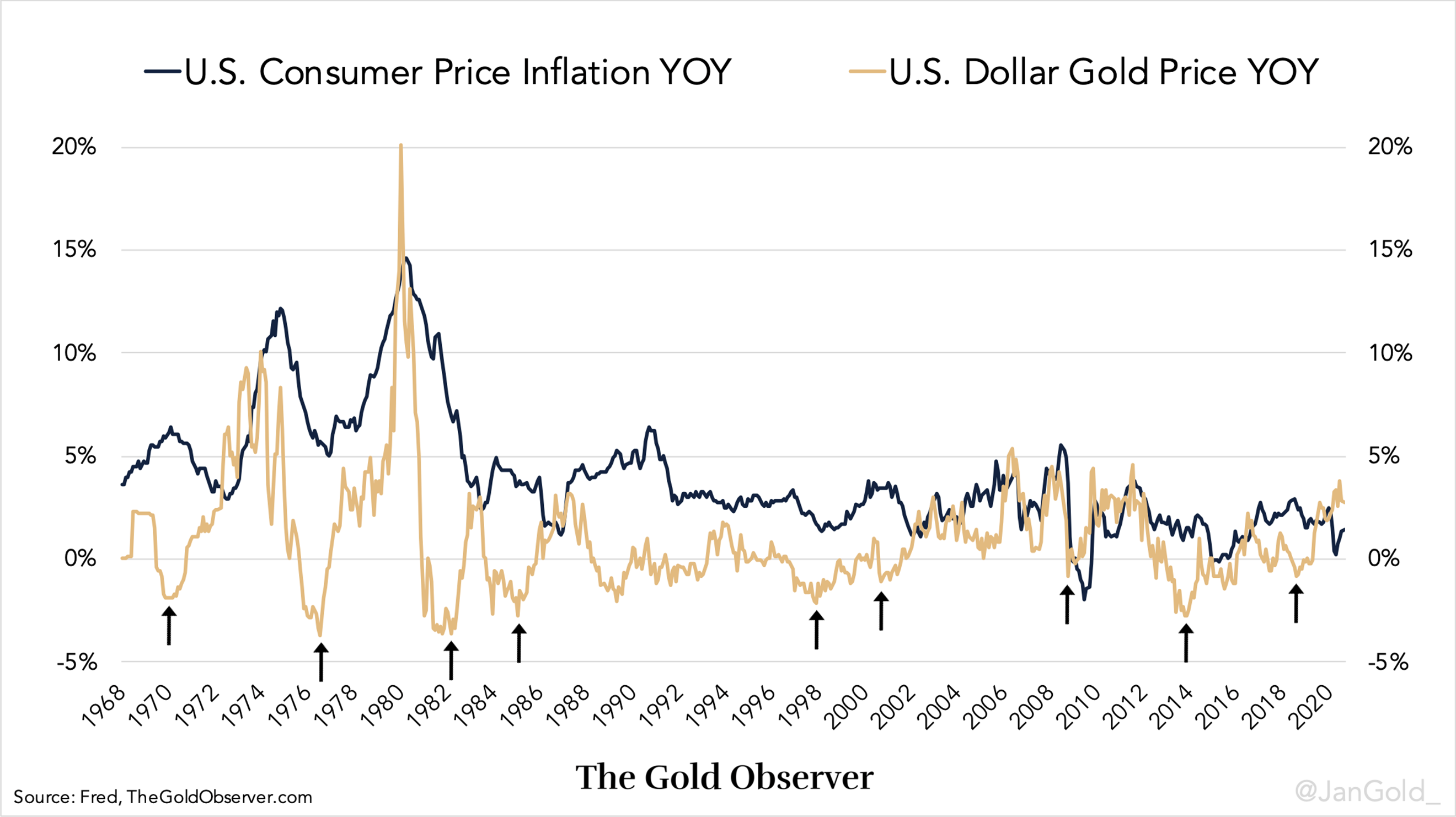

Strictly speaking, there is no economic law that guarantees that a higher gold price will create inflation.

Though, historically the gold price has been an expression of inflation expectations. In turn, inflation expectations are what feed into inflation. So, when the gold price goes up, inflation usually rises within a year or two.

The current pandemic may not last forever. Are we heading towards a new monetary system that incoporates gold? It is anyone’s guess on how this will be structured going forward.

Is it a sign that we should be long on gold? We think so.

Source:

https://thegoldobserver.substack.com/p/gold-is-the-only-way-out-for-central